|

[1]

|

文丹艳, 马超群, 王琨. 一种多源数据驱动的自动交易系统决策模型. 自动化学报, 2018, 44(8): 1505−1517Wen Dan-Yan, Ma Chao-Qun, Wang Kun. A multi-source data driven decision model for automatic trading systems. Acta Automatica Sinica, 2018, 44(8): 1505−1517

|

|

[2]

|

孙彦林, 陈守东, 刘洋. 基于股市和汇市成交量信息视角的股价波动预测. 系统工程理论与实践, 2019, 39(4): 935−945 doi: 10.12011/1000-6788-2018-1985-11Sun Yan-Lin, Chen Shou-Dong, Liu-Yang. Forecast of stock price fluctuation based on the perspective of volume information in stock and foreign exchange market. Systems Engineering-Theory & Practice, 2019, 39(4): 935−945 doi: 10.12011/1000-6788-2018-1985-11

|

|

[3]

|

伍燕然, 韩立岩. 不完全理性、投资者情绪与封闭式基金之谜. 经济研究, 2007, (3): 117−129Wu Yan-Ran, Han Li-Yan. Imperfect rationality, sentiment and closed-end-fund puzzle. Economic Research Journal, 2007, (3): 117−129

|

|

[4]

|

乌达巴拉, 汪增福. 一种基于组合语义的文本情绪分析模型. 自动化学报, 2015, 41(12): 2125−2137Odbal, Wang Zeng-Fu. Emotion analysis model using compositional semantics. Acta Automatica Sinica, 2015, 41(12): 2125−2137

|

|

[5]

|

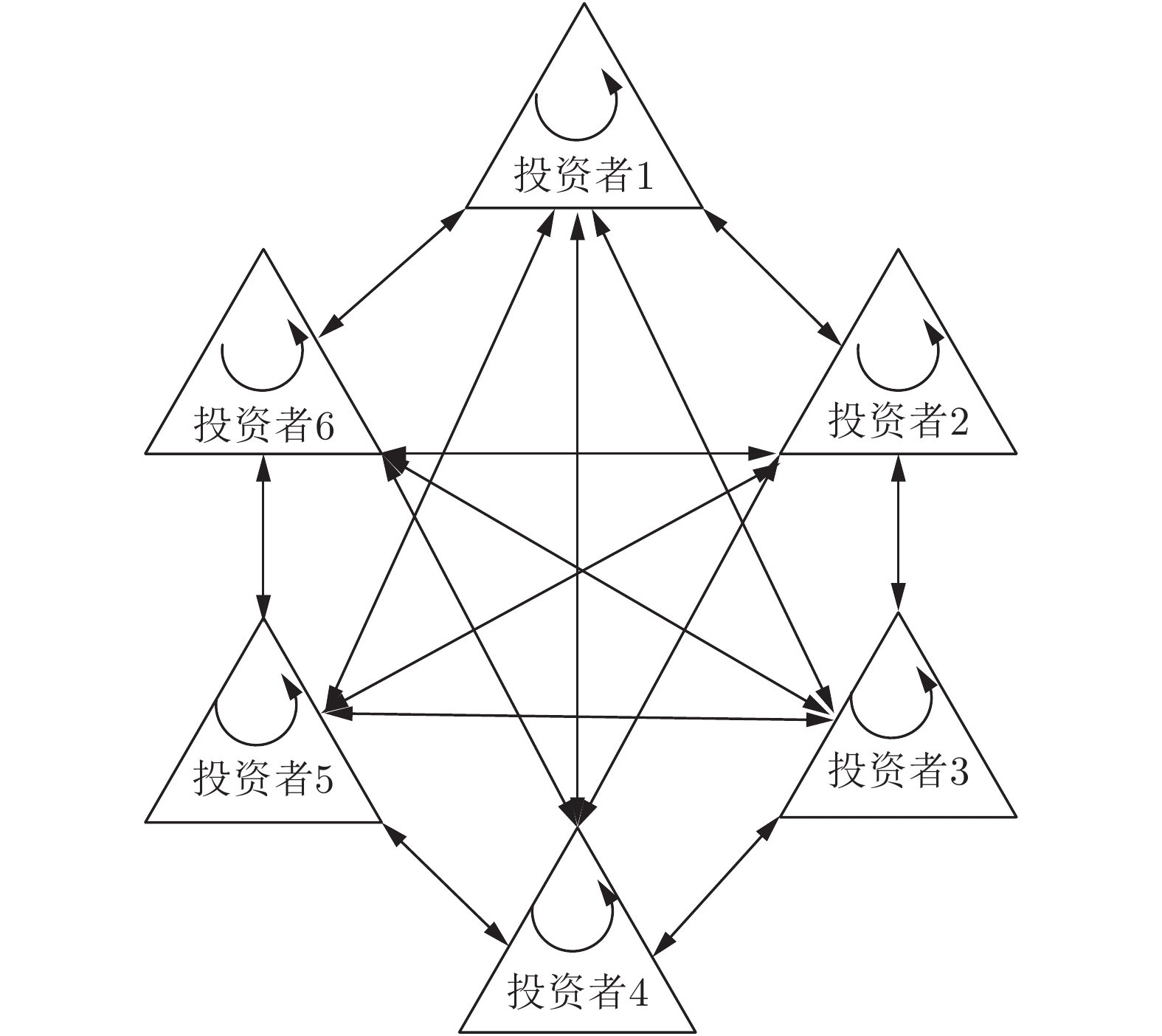

郭东伟, 乌云娜, 邹蕴, 孟祥燕. 基于非理性博弈的舆情传播仿真建模研究. 自动化学报, 2014, 40(8): 1721−1732Guo Dong-Wei, Wu Yun-Na, Zou Yun, Meng Xiang-Yan. Simulation and modeling of non-rational game based public opinion spread. Acta Automatica Sinica, 2014, 40(8): 1721−1732

|

|

[6]

|

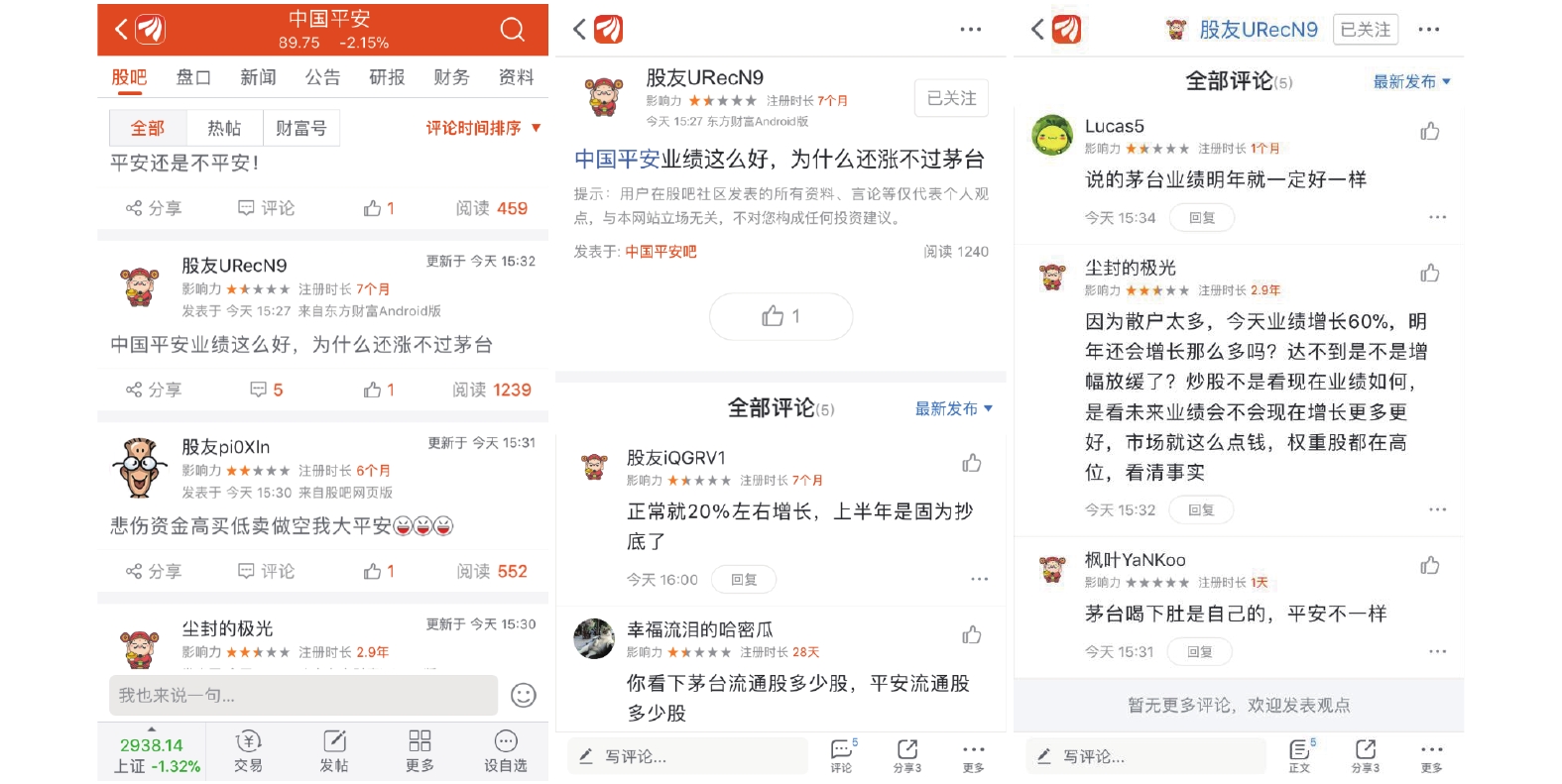

部慧, 解峥, 李佳鸿. 基于股评的投资者情绪对股票市场的影响. 管理科学学报, 2018, 21(4): 91−106Bu Hui, Xie Zheng, Li Jia-Hong. Investor sentiment extracted from internet stock message boards and its effect on Chinese stock market. Journal of Management Sciences in China, 2018, 21(4): 91−106

|

|

[7]

|

Sul H K, Dennis A R, Yuan L. Trading on Twitter: using social media sentiment to predict stock returns. Decision Sciences, 2017, 48(3): 454−488 doi: 10.1111/deci.12229

|

|

[8]

|

许启发, 伯仲璞, 蒋翠侠. 基于分位数Granger因果的网络情绪与股市收益关系研究. 管理科学, 2017, 30(3): 147−160 doi: 10.3969/j.issn.1672-0334.2017.03.013Xu Qi-Fa, Bo Zhong-Pu, Jiang Cui-Xia. Exploring the relationship between Internet sentiment and stock market returns based on quantile granger causality analysis. Journal of Management Science, 2017, 30(3): 147−160 doi: 10.3969/j.issn.1672-0334.2017.03.013

|

|

[9]

|

Scott J. Social Network Analysis (4th Edition), London, U.K.: Sage Publications Ltd, 2017.

|

|

[10]

|

Acemoglu D, Ozdaglar A. Opinion dynamics and learning in social networks. Dynamic Games and Applications, 2011, 1(1): 3−49 doi: 10.1007/s13235-010-0004-1

|

|

[11]

|

Yuan Y. Market-wide attention, trading, and stock returns. Journal of Financial Economics, 2015, 116(3): 548−564 doi: 10.1016/j.jfineco.2015.03.006

|

|

[12]

|

吴璇, 田高良, 司毅. 网络舆情管理与股票流动性. 管理科学, 2017, 30(6): 51−64 doi: 10.3969/j.issn.1672-0334.2017.06.004Wu Xuan, Tian Gao-Liang, Si Yi. Internet media management and stock liquidity. Journal of Management Science, 2017, 30(6): 51−64 doi: 10.3969/j.issn.1672-0334.2017.06.004

|

|

[13]

|

Bozorgi A, Samet S, Kwisthout J, Wareham T. Community-based influence maximization in social networks under a competitive linear threshold model. Knowledge-Based Systems, 2017, 134: 149−158 doi: 10.1016/j.knosys.2017.07.029

|

|

[14]

|

Zhang X, Jiang D, Alsaedi A, Hayat T. Stationary distribution of stochastic SIS epidemic model with vaccination under regime switching. Applied Mathematics Letters, 2016, 59: 87−93 doi: 10.1016/j.aml.2016.03.010

|

|

[15]

|

熊熙, 乔少杰, 吴涛, 吴越, 韩楠, 张海清. 基于时空特征的社交网络情绪传播分析与预测模型. 自动化学报, 2018, 44(12): 2290−2299Xiong Xi, Qiao Shao-Jie, Wu Tao, Wu Yue, Han Nan, Zhang Hai-Qing. Spatio-temporal feature based emotional contagion analysis and prediction model for online social networks. Acta Automatica Sinica, 2018, 44(12): 2290−2299

|

|

[16]

|

Liu X, He D, Liu C. Information diffusion nonlinear dynamics modeling and evolution analysis in online social network based on emergency events. IEEE Transactions on Computational Social Systems, 2019, 6(1): 8−19 doi: 10.1109/TCSS.2018.2885127

|

|

[17]

|

Zhuang Y, Yagan O. Information propagation in clustered multilayer networks. IEEE Transactions on Network Science and Engineering, 2016, 3(4): 211−224 doi: 10.1109/TNSE.2016.2600059

|

|

[18]

|

Jackson M O. Social and Economic Networks. Princeton, NJ, USA: Princeton University Press, 2008

|

|

[19]

|

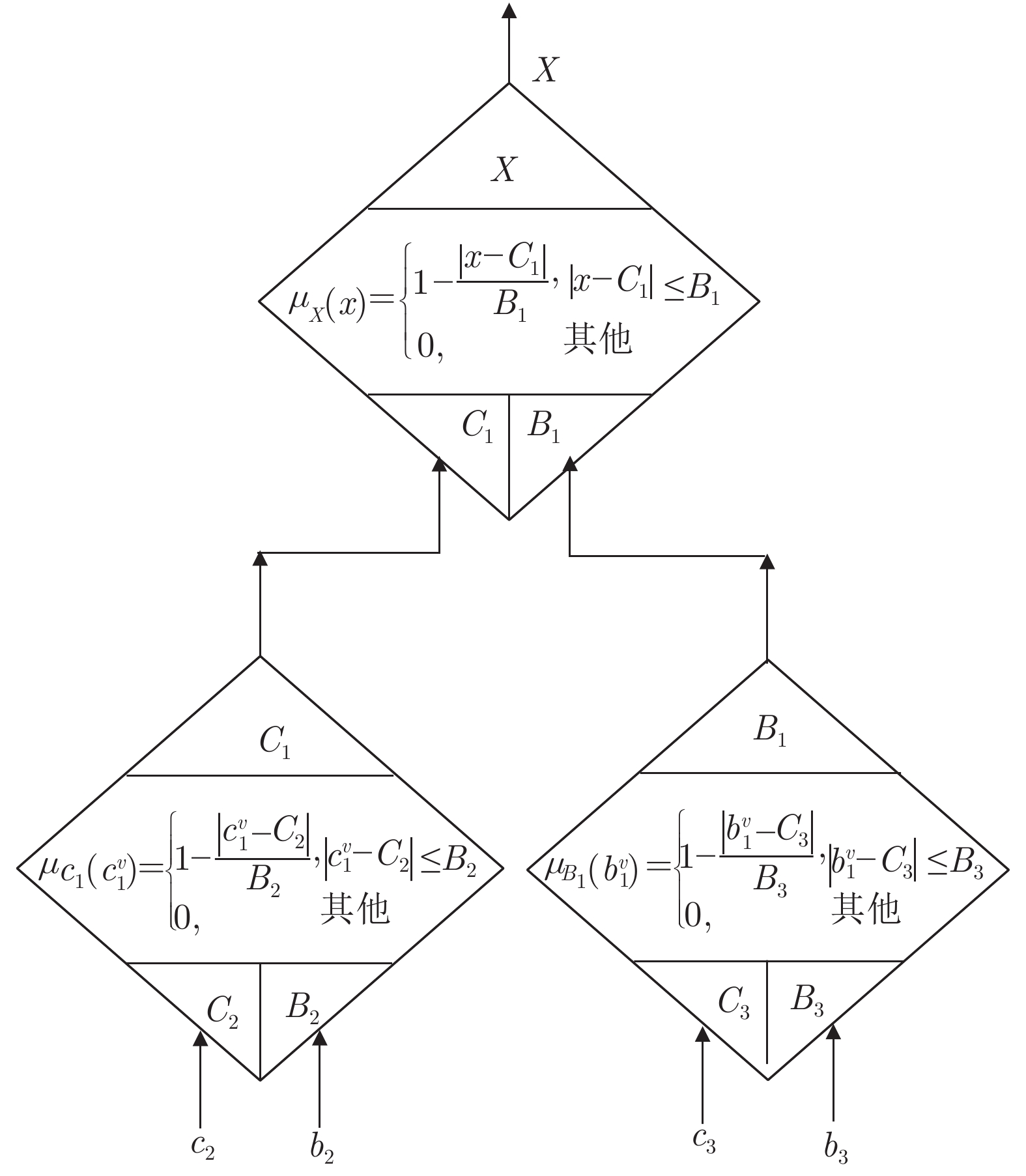

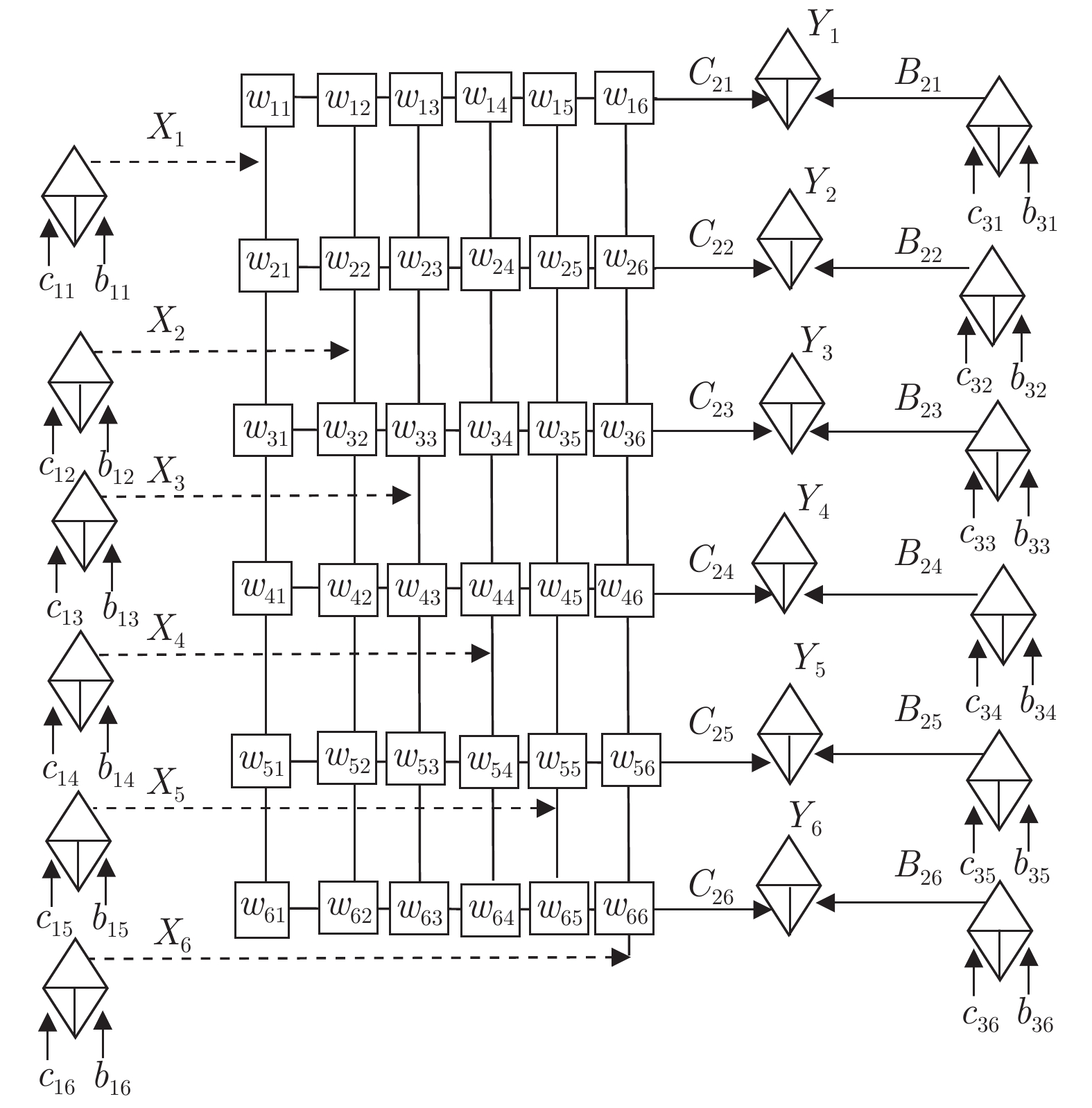

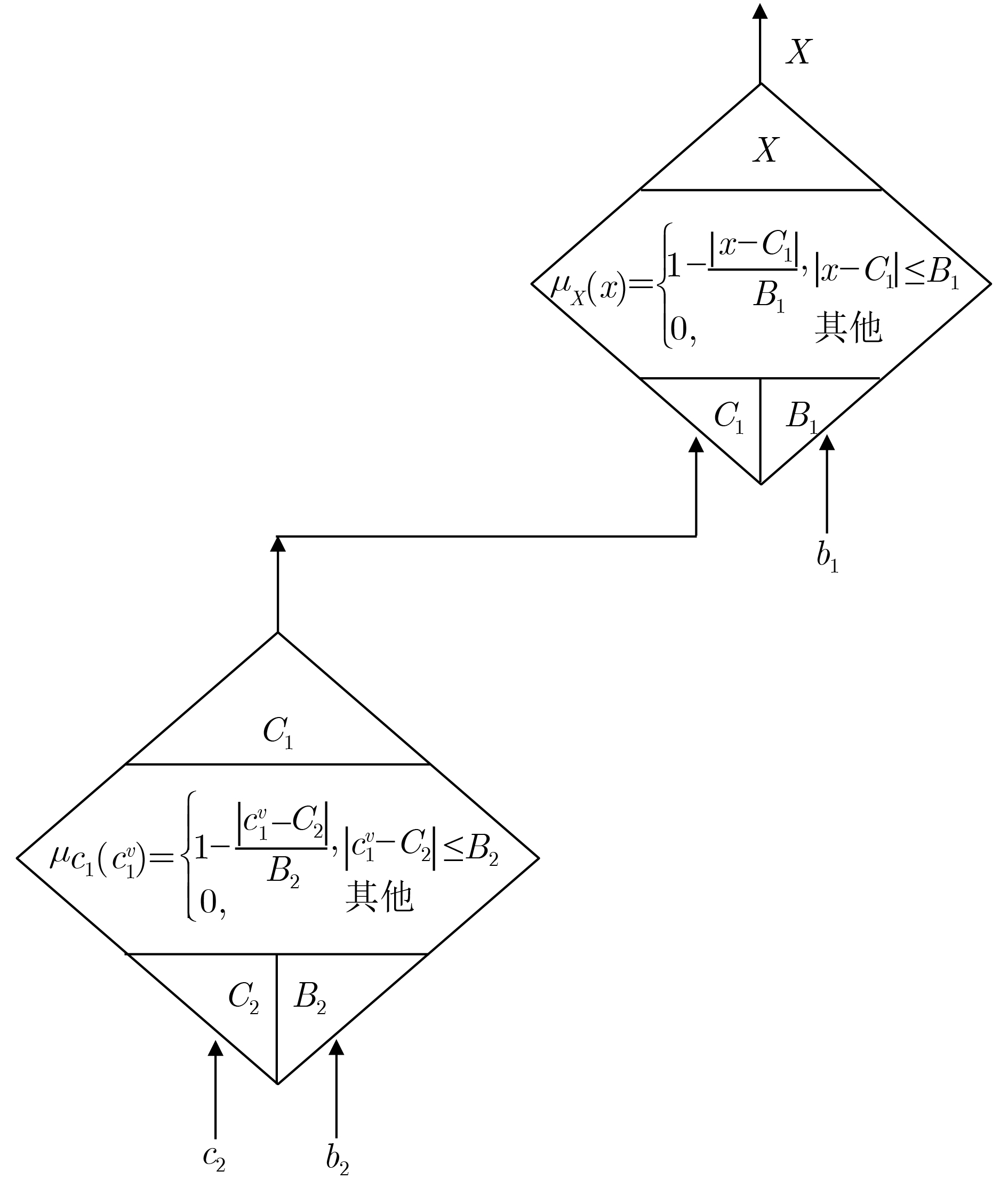

Wang L X, Mendel J M. Fuzzy opinion networks: a mathematical framework for the evolution of opinions and their uncertainties across social networks. IEEE Transactions on Fuzzy Systems, 2016, 24(4): 880−905 doi: 10.1109/TFUZZ.2015.2486816

|

|

[20]

|

Wang L X, Mendel J M. Fuzzy networks: What happens when fuzzy people are connected through social networks. In: Proceedings of the 2014 IEEE Symposium on Foundations of Comput-ational Intelligence (FOCI). Orlando, FL, USA: IEEE, 2014. 30-37

|

|

[21]

|

Wang L X. Hierarchical fuzzy opinion networks: top-down for social organizations and bottom-up for election. arXiv preprint, arXiv: 1901.00441, 2019

|

|

[22]

|

Hommes C H. Heterogeneous agent models in economics and finance. Handbook of Computational Economics, 2006, 2: 1109-1186

|

|

[23]

|

Wang L X. Modeling stock price dynamics with fuzzy opinion networks. IEEE Transactions on Fuzzy Systems, 2017, 25(2): 277−301 doi: 10.1109/TFUZZ.2016.2574911

|

|

[24]

|

Lux T. Estimation of an agent-based model of investor sentiment formation in financial markets. Journal of Economic Dynamics and Control, 2012, 36(8): 1284−1302 doi: 10.1016/j.jedc.2012.03.012

|

|

[25]

|

Anzilli L, Facchinetti G. A Fuzzy quantity mean-variance view and its application to a client financial risk tolerance model. International Journal of Intelligent Systems, 2016, 31(10): 963−988 doi: 10.1002/int.21812

|

|

[26]

|

Chen H M, Hu C F, Yeh W C. Option pricing and the greeks under gaussian fuzzy environments. Soft Computing, 2019, 23(24): 13351−13374 doi: 10.1007/s00500-019-03876-w

|

|

[27]

|

Baker M P, Wurgler J. Investor dentiment and the cross-section of stock returns. Economic Management Journal, 2006, 61(4): 1645−1680

|

|

[28]

|

Da Z, Engelberg J, Gao P. The sum of all FEARS investor sentiment and asset prices. Review of Financial Studies, 2014, 28(1): 1−32

|

|

[29]

|

Zadeh L A. Is there a need for fuzzy logic? Information Sciences, 2008, 178(13): 2751−2779

|

|

[30]

|

Zadeh L A. Outline of new approach to the analysis of complex systems and decision processes. IEEE Transaction Systems, Man, and Cybernetics, 1973, SMC-3(1): 28−44 doi: 10.1109/TSMC.1973.5408575

|

|

[31]

|

Zadeh L A. The concept of a linguistic variable and its application to approximate reasoning-I. Information Sciences, 1975, 8(3): 199−249 doi: 10.1016/0020-0255(75)90036-5

|

下载:

下载: